The world’s economy is standing on international trade and we all know that. But do we all know about “INCOTERMS”? You must heard this word from some newspapers, news shows, magazines, or from any talking related to global trade. This is because it is a very usual term for international business. Familiarizing with this term will help you to improve your knowledge about the worldwide business how these transactions occur and whose task is up to what extent in the transactions. So let’s trace out all about the “INCOTERM”.

Incoterm is defined as an association of some rules applied to the business across the borders of every country. Every country must abide by these rules to make transactions of goods globally. These rules were first established by “The International Chamber of Commerce, (ICC)” in 1936. ICC is the most diverse business organization in the world. It was founded in 1919 during the uncertainty of WW1 to smoothen and reserve the world trade. Also, ICC represents 45 million companies from 100 countries approximately.

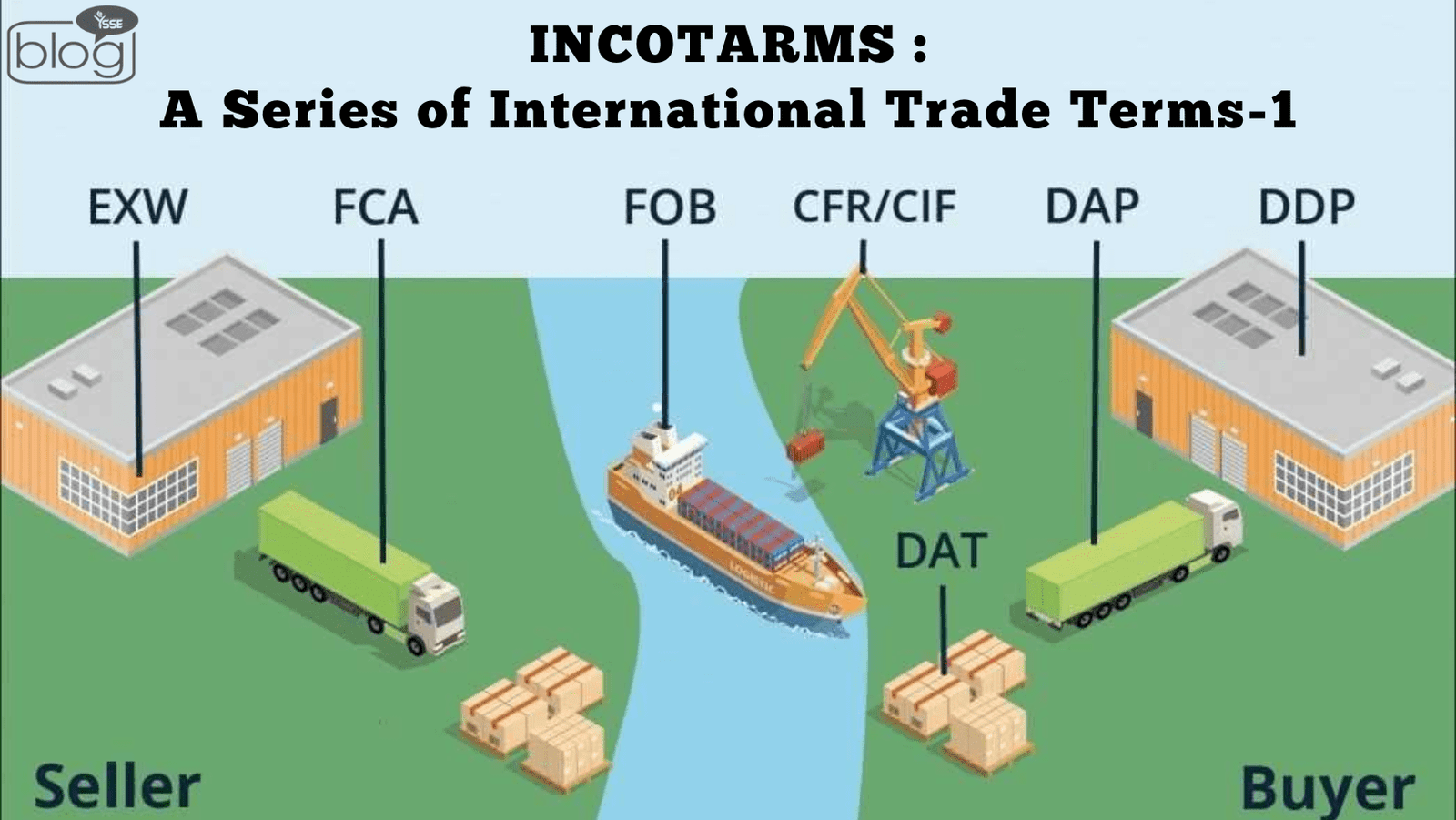

It is important to understand the trade rules for understanding international business. So let’s get into the definitions of all the incoterms:

-

- EXW – Ex Works: EXW represents that the seller has the least obligations for the transaction. He only has to place goods at the disposal of the buyer. The buyer or customer must do all the tasks of export as well as import clearance. He mainly takes the responsibilities of loading, transportation, clearance, and unloading. But the seller is only responsible for having the product at his premises.

- FCA – Free Carrier (Named Place of Delivery): It describes that the seller delivers the goods. He also clears for the carrier nominated by the buyer at the named place. He pays for a carriage to the named place. But the buyer pays for carriage to the port of import. The buyer pays for insurance also.

- FAS – Free Alongside Ship: This term implies that the seller delivers when the goods are placed alongside the vessel at the named port of shipment. The vendor needs to clear the goods for sale across the border. The buyer has to carry all costs and risks of loss to the goods from that moment. It is only used for sea transport.

- FOB – Free On Board: It is the acronym of “Free On Board”. This is actually a pricing system. It is the most popular pricing system in Bangladesh. The price mentioned in the purchase order without the transportation cost, then that price is called the FOB price. But the cost of the transportation will have to be paid by the seller, even if it’s excluded from the FOB price. We can showcase the pricing system as –

FOB = All manufacturing cost + CM + Profit + transport cost from factory to manufacturer port.

- CFR – Cost and Freight: This is also a costing system. It covers the actual cost of goods and the transportation cost. When this cost is written on the PO meaning “Purchase Order”, it’s called CFR costing. It is the responsibility of seller to send the goods to the buyer’s port.

- CIF – Cost, Insurance, and Freight: In this, the seller bears freight and insurance costs to the named port. The risk is handed over when the goods have been loaded on the vessel. The seller has to obtain minimum insurance coverage complying with Institute Cargo Clauses in the buyer’s name. It is followed by –

CIF = CFR + Insurance

This part of the blog rests here with these incoterms according to ICC incoterms 2020. Some other terms are followed by so many business executions across the border.

To read more blogs like this click here

Writer,

Adri Sen,

Intern

Content Writing Department

YSSE